Anthony Tripolino FIPA: Lessons from teenage side hustles

Having proven his entrepreneurial flair as a teenager, Anthony Tripolino FIPA was taught lessons around work ethic by...

READ MORE

As expected, the federal budget handed down on 6 October had a number of significant business tax initiatives and job creation policies as its centerpiece to reboot an economy savaged by financial impacts of COVID-19.

The economic shock from COVID has far exceeded what was experienced during the GFC, which represented our most recent blip on a stellar growth trajectory that the Australian economy has enjoyed for close to 30 years.

The federal government’s initial response to COVID was to put substantial income support into the economy. Both JobKeeper and cash flow boost were the main initiatives that were deployed early to deal with restrictions put in place that effectively put businesses into a forced coma or hibernation mode.

The federal budget is now trying to transition businesses away from these initiatives to the recovery phase. It is all about incentives in the hope of rebooting business activity by going hard on a number of tax measures and wage subsidies. The gates have been opened wide as some of the tax measures are uncapped and apply to entities with up to a turnover up to $5 billion, which will cover 99 per cent of all businesses.

The government intention is that the business community reacts positively to these concessions. It wants to grow the economy so that businesses start employing people again, especially those that have been displaced during the pandemic. Simple economics at its core and everyone is hoping that it does what is intended as our debt will soar to over a trillion dollars to fund these initiatives. It’s akin to adding yeast to flour or fuel to an ember.

The economy is made up of individuals and it will require these individuals to spend and the business community to have the confidence to invest and start hiring as economic activity starts to build again.

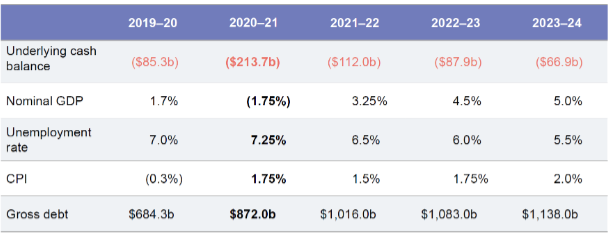

As promised, the government delivered no tax increases. Its priority is to grow the economy or the economic pie. The core focus is to reduce the unemployment figure to below 6 per cent before it changes its fiscal strategy to budget repair.

According to government estimates, the earliest we can expect this to happen is 2023–24 and therefore this is when we can expect to see fiscal repair (higher taxes) kick in. Subdued levels of GDP are to continue and start recovering to normal levels by 2021–22.

A lot of the measures are temporary and will result in a pull forward of activity. This will give the government some breathing space to think about all the structural reforms it will need to address to maintain long-term sustainability of the growth generated by the massive business concessions put in place. This is the more challenging aspect, as addressing structural reforms in not easy. Our lagging productivity pre-COVID is partly due to significant reform inactivity over the last two decades. Tax concessions and spending initiatives are easier to implement than significant structural reforms.

Most of the tax measures in the federal budget are contained in Treasury Laws Amendment (A Tax Plan For the COVID-19 Economic Recovery) Bill 2020, which passed into law within three days of budget being handed down. The bill included five tax measures, namely backdated income tax cuts, instant asset write-off, loss carry-back, small business concessions expansion and the R&D tax incentive amendments.

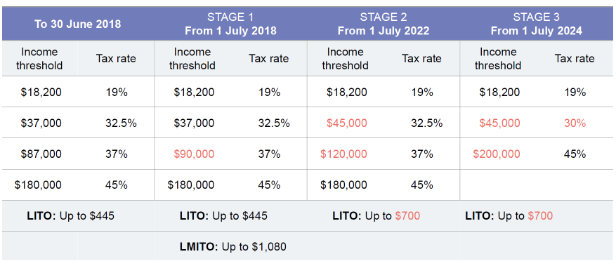

Personal tax cuts – Bringing forward stage 2 tax cuts

The purpose of bringing forward the stage 2 tax cuts was to stimulate extra spending in the economy and act as a de facto wage increase for many. Putting more cash into the pockets of middle-income earners who are more likely to spend, was the main driver. Wage growth is almost non-existent, so the tax cut will be a welcomed boost to disposable incomes. Stage 2 tax cuts are retrospective and are effective from 1 July 2020.

The ATO released revised withholding tax tables on 14 October and have advised all employers that they must implement these changes by 16 November. The ATO could not build the accrued tax savings into the new withholding rates. The accrued tax savings will flow to taxpayers when they lodge their 2020-21 tax return, meaning no earlier than from July 2021 next year. This was confirmed by the ATO on 9 October as follows:

“The adjustments to the withholding schedules are designed to ensure that taxpayers have the correct amount of tax withheld from their pay going forward. It is not possible for the ATO to determine the extent of ‘over-withholding’ that may have occurred for each and every taxpayer as this is highly dependent on individual circumstances and will be different for everyone. Any ‘over-withholding’ that occurred prior to the employer updating their payroll software and processes will be included in the tax assessment of the employee at the end of the income year.”

Building the accrued tax cuts into the remaining months of the year would have been problematic for the ATO. It is anticipated that there will be a rush on early lodgments again next year when taxpayers realise that there is money on the table. Someone earning more than $120,000 has already accrued over $700 of personal tax savings.

The one upside is that taxpayers earning income outside of an employment arrangement who pay tax quarterly as part of their activity statement obligations can immediately vary down their tax obligations to take advantage of the stage 2 tax cuts.

The government flagged early its intention of bringing forward stage 2 of the already legislated Personal Income Tax Plan. What was unexpected was the retention of the low and middle income tax offset (LMITO) until 1 July 2021, as it was meant to be repealed when the stage 2 cuts came into force.

These changes translate into the following savings:

NANE treatment of state and territory government business support grants

The federal budget confirmed that it will make the Victorian government’s business support grants for small- and medium-sized business – as announced on 13 September 2020 – non-assessable, non-exempt (NANE) income for tax purposes.

The federal government will extend this arrangement to all states and territories on an application basis. Eligibility would be restricted to future grants program announcements for small- and medium-sized businesses that are facing similar circumstances to Victorian businesses.

The government will introduce a new power in the income tax laws to make regulations to ensure that specified state and territory COVID-19 business support grant payments are NANE income. Eligibility for this treatment will be limited to grants announced on or after 13 September 2020 and for payments made between 13 September 2020 and 30 June 2021.

The tax law will provide that all similar state and territory government grants are treated as NANE income. For JobKeeper purposes, these grants would be excluded from current GST turnover as the entity would not be taken as to have made a supply (no reciprocal arrangements) in order to receive the grant.

The cash flow boost is also NANE income. If you distribute an amount representing the NANE income, the tax consequences will depend on the type of entity making the distribution and can be summarised as follows:

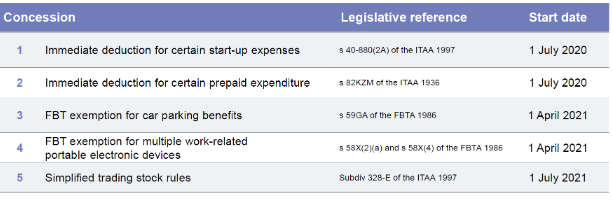

Small business concessions extended to cover more businesses

The small business turnover threshold will be increased from $10 million to $50 million. Effectively moving a suite of tax concessions up the food chain to a larger number of entities.

Depending on individual circumstances, some of these concessions such as immediate deduction for prepayments can be advantageous as it enables deductions to be brought forward.

In relation to the two-year amendment period, there are exceptions so be aware as it does not extend to all taxpayers. Also, in relation to start dates, some of the tax concessions start immediately and apply for the current income year, while others commence as from 1 July 2021.

The FBT concessions start from the beginning of the next FBT year namely, 1 April 2021.

The return of loss carry back

Making a comeback is loss carry back. When it was first introduced it was funded by the mineral resource rent tax and when this tax was repealed in 2014, all associated tax measures it funded such as loss carry back were also repealed. Instead of carrying losses forward to be offset against future taxable profits, a corporate entity will be able to claim a refundable tax offset. This effectively means the corporate entity obtains a more immediate cash flow benefit instead of having to wait for a future tax period to offset the carried forward loss. One of its desirable features is that it acts as an automatic stabiliser by providing increased cash flows to businesses during an economic downturn such as what we are experiencing due to COVID.

Loss carry back will be highly attractive for corporate tax entities that were profitable, and paid tax in any of the 2018–19 to the 2020–21 income years, and have made a tax loss in any of the 2019–20 to the 2021–22 income years. Entities will be able to elect to carry an eligible loss back and claim a refundable tax offset or carry it forward under the normal rules. Entities will need to wait till at least the 1 July 2021 in order to get their hands on the cash as the tax offset is only available in the 2020-21 income year or in the 2021-22 income year.

Loss carry back will be more generous than the version that was repealed back in 2014, as the refundable tax offset was capped at $300,000. While the current loss carry back is uncapped, it is effectively limited to the entity’s franking account balance and the amount of the entity’s earlier taxed profits. It goes without saying that it only applies to businesses that are incorporated. As the majority of small businesses are unincorporated, many cannot avail themselves of this measure.

Immediate deductions for investment in capital assets

The news is good in that we have uncapped expensing of capital assets acquired after 7:30pm on 6 October 2020. And yes, it does mean uncapped subject to normal exclusion of certain assets (i.e. buildings) and the application of the car cost limit. All the revisions to the instant asset write off (IAWO) thresholds from $20,000 to $25,000 to $30,000 to $150,000 and now full expensing, has most practitioners grasping for air trying to keep up with all the changes and dates they apply from.

This is where we have landed for full expensing:

Full expensing represents utopia. No tracking of depreciable assets or pooling rules to adhere to and the business obtains the full tax benefit of the outlay. It does not get any better than that. The only downside is if you sell the depreciable asset in a new tax period, the proceeds will represent assessable income as the written down value is nil.

For small business entities (SBEs), they would have been required to write off the balance of their general small business pools if the low pool value was less than $150,000 as at 30 June 2020. If their low value pool was greater than $150,000, they will be required to write off the pool balance on 30 June 2021.

Superannuation

Constant tinkering has been the norm, so no news is good news when it comes to superannuation. The only changes in the budget were around improving transparency and governance issues. One group who is constantly ignored are self-funded retirees. This group is already facing enough headwinds with declining dividends on share investments and almost negligible interest rates on term deposits.

Final word

There is a lot riding on the series of measures put in place to kick start economic activity. There are a trillion reasons riding on it. The government wants consumers to spend and businesses to invest. Both of which will encourage employers to start hiring again. We all have a role to play in the recovery process. The measures now need to generate enough momentum and confidence to jump the gap between JobKeeper receding and consumers and businesses sensing a tangible recovery is here to stay.

Assuming all goes to plan, the government will need to implement a series of structural reforms to maintain the momentum and turn it into long-term sustainable growth, as we cannot keep throwing more borrowed money to generate activity.

The hard and overdue reforms required to restore and sustain prosperity are now no longer a choice if we are to slowly restore Australia’s balance sheet.

Tony Greco FIPA general manager of technical policy, IPA