Equipping professional accountants for sustainability

The International Federation of Accountants has developed a concise resource to guide accounting professionals and...

READ MORE

New research has found that excessive banking red tape has "robbed" Australian business owners of four weeks of work per year, at a cost of $7 billion to the economy.

Tyro’s Exploring banking inefficiencies for SMEs report has found that 44 per cent of Australian SMEs, or 880,000 businesses, spend more than three hours every week paying bills and checking, entering and reconciling data, costing each business an average of $7,800 a year.

Tyro, an independent EFTPOS banking institution, also found that:

“Large companies, with more than 200 employees, make up only 0.3 per cent of businesses operating in Australia,” said Tyro CEO Jost Stollmann.

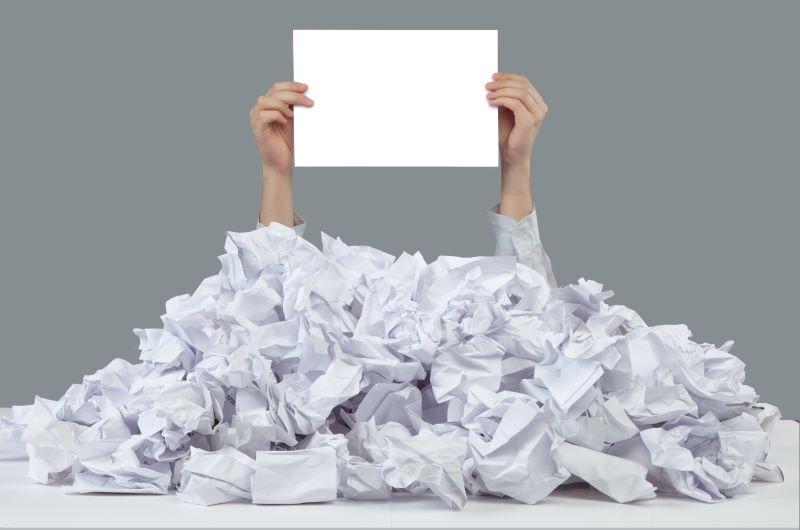

“By comparison, small and medium sized businesses are the creative and innovative heart of the Australian economy, generating more jobs than any other sector. But SMEs are drowning under the burden of inefficient online business banking processes that are robbing them of three hours a week, or 20 days a year."

According to Mr Stollmann, this means that SMEs have to work a 13-month year, or give up the equivalent of four weeks’ annual holiday in order to "compensate for banking inefficiencies".

Mr Stollmann said efficient online banking is critical to the success of SMEs and a large proportion of Australian businesses are seeing their banks letting them down.

“Banks need to try harder to reduce the burden on Australian businesses,” he said.