Equipping professional accountants for sustainability

The International Federation of Accountants has developed a concise resource to guide accounting professionals and...

READ MORE

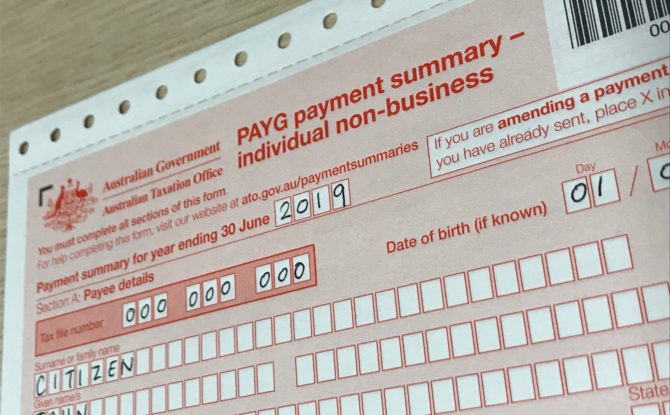

The Australia Taxation Office will not apply penalties and interest on varied instalments that relate to the 2021-22 income year it announced on Wednesday (13 October).

Due to the ongoing impacts and economic uncertainty of COVID-19, the Tax Office said penalties will not apply if customers have taken reasonable care to estimate their end-of-year tax liability.

Customers need to have made a reasonable and genuine attempt to determine their liability and the ATO said if a genuine attempt has been made, it will take into account what a reasonable person would have done in your circumstances.

This will apply to 30 June ordinary balancers for the 2022 income year and entities that have been granted a substituted accounting period (SAP). For an entity with a SAP, any variation must relate to instalments made during your 2022 income year.

You can vary your instalments multiple times throughout the year. Your varied amount or rate will apply for all your remaining instalments for the income year or until you make another variation.

You should ensure the total of your instalments for the income year are as close as possible to your tax liability for that year and paid proportionally across the year.