How to be financially fit in 2024

As we settle into the new year, it is an opportunity to reassess your financial health to help you start the year off...

READ MOREPromoted by Dext.

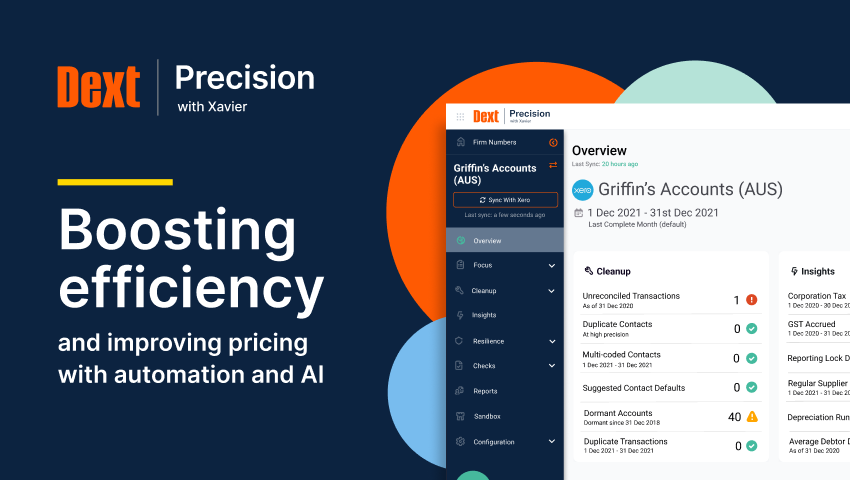

Have you considered using advanced automation and AI in your accounting firm? Here, we explain how to use this technology in a way that creates efficiencies and offers better service, ultimately leading to increased profitability for an accounting firm.

Technology is evolving at an accelerated pace, with AI now able to take on tasks that only humans used to be able to perform – such as reviewing information, ‘thinking’, making decisions and anticipating possible outcomes.

For an accounting firm, AI and advanced automation should be viewed as an exciting development rather than a daunting one, as implementing these technologies effectively can lead to greater efficiency, enhanced client experience and ultimately, improved profitability. In this article, we’ll explore two ways that advanced technology can work to grow an accounting practice:

When contemplating whether it’s worth making an investment in any technology, it’s important to factor in opportunity cost. How much is the time the technology saves worth to you, and what higher-value client work could you be doing in that time?

Advanced automation and AI can save time through:

For example, a product like Dext Precision gives you visibility over all your clients that are on Xero or QBO, so you can easily see where there may be issues with the quality of the client’s data and decide where team resources should be allocated.

Dext Precision also offers automated file reviews, which provide a more accurate and efficient way of ensuring quality control. It also uses AI to highlight key areas of focus for the accountant and bookkeeper.

Charging better instead of charging more

As an accounting firm, the quality control and accuracy that comes from AI is of course favourable to clients and helps you prove your worth when it comes to billing. Increased efficiency also means more billable hours in the day.

However, AI can improve profitability further by enabling more accurate pricing – charging better instead of charging more. Most accountants struggle to challenge what they charged the previous year, irrespective of how much time they are spending. Often, that’s because they don’t have the information readily available to do it any other way. That is, until they start using AI.

For example, accounting firms often spend time sorting out poor quality data and inaccurate records before they even get to the work they’re being paid to do. A program like Dext Precision has a ‘healthscore’ function, so if you find a client’s data quality is poor, then you know in advance and can charge them a one-off fee for cleaning it up before you start the work you are actually being paid to do.

Dext Precision also has insights which can prevent you from over-servicing a client. For example, you can visualise and analyse the detailed client activity within the accounting file. This information provides you with the opportunity to contact these clients and have a conversation about the additional services you are providing. The data Precision generates will help you back up these conversations.

Other ways advanced technology makes your pricing more accurate include access to real-time information, which allows for better client discussions, and the ability to set more accurate expectations around turnaround of work.

Higher level insights

Once you get a picture of what your pricing structures should be, the next step is to explore how AI can provide higher level insights about client data that allow an accountant to be really proactive.

Advice around business performance is currently a hot topic among small to medium businesses. Accountants can use data insights generated by programs like Dext Precision to add value by helping clients understand how their business is performing, what they’re spending and where, predictions for their cash flow, and where their net assets stand. One powerful feature is the Precision Customer Reliance Graph, which allows an accountant to see whether their client’s sales are overly reliant on one or two key customers. Then, the accountant can offer this as valued advice. A similar one can be generated for supplier reliance - a key insight in an age where supply chain delays are still common.

When deciding on an AI/automation technology solution, the first step is to identify the problem and choose the solution with a strong purpose in mind. Once implemented, it’s important to trust the technology and advanced automation tools – otherwise, you will not see the benefits.

To make sure everyone in the practice is on board, try putting in place the following three measures:

AI and advanced automation software like Dext Precision has an exciting role to play in an accounting firm – ensuring you’re always one step ahead of the data, offering value to clients, using your time efficiently, pricing accurately and ultimately improving profitability.

Are you interested in seeing how Dext Precision can take your firm to the next level of service and profitability? We’re currently running a limited offer of 50% off for your first three months. Contact us today to get started - https://bit.ly/35KBI8B