ATO governance needs reform: IPA-Deakin SME Research Centre

The IPA-Deakin SME Research Centre has examined the shortcomings of the ATO’s governance model and proposed a Tax...

READ MORE

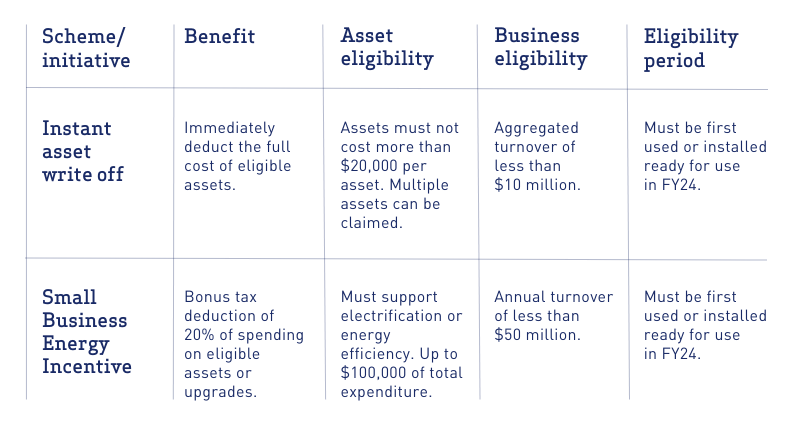

In the lead up to EOFY, one item to add to the agenda for every client conversation: The instant asset write-off scheme. Here’s our run-down of the changes your clients need to know, with a handy email template to help you keep them informed and start a conversation about FY24 growth plans.

Last month on Budget night, we had hoped to hear that temporary full expensing would be extended or, at least, that there would be consideration for businesses impacted by supply chain challenges with assets that had been ordered and paid for, but which were not yet installed or ready for use.

However, we heard that the measure will end with the financial year. From 1 July, we will revert to the previous instant asset write off scheme, but with a higher threshold.

Rather than dropping immediately to $1,000, the threshold will be $20,000 per asset until 30 June 2024, which means that eligible businesses with revenue under $10 million will be able to write off the full value of eligible assets up to $20,000 that are first used or are installed ready for use during FY 2023-24.

With the threshold applying per asset rather than per business, multiple assets up to $20,000 that meet the criteria can be written off immediately.

Accountants need to have a conversation with their clients about the changes that are coming, and how they will impact capital asset plans.

Those planning to take advantage of temporary full expensing need to do so before EOFY, with the asset installed and ready for use. Those considering purchases early in the new FY may consider bringing those plans forward to take advantage of the scheme, but cash flow impacts need to form part of the decision. Will that earlier-than-planned expenditure come with an opportunity cost if other initiatives must be forgone?

Other business owners and leaders who plan to invest in assets up to $20,000 in the next FY and take advantage of the instant asset write off should not count on the temporary measure extending beyond 30 June 2024 – the assets must be ready for use by that date.

Reflecting on recent supply chain challenges, little should be left to chance in meeting that deadline.

Those businesses considering assets that are eligible for the Small Business Energy Incentive may consider waiting until after EOFY regardless of the the end of temporary full expensing.

Eligible businesses will be able to claim a bonus tax deduction of 20% for spending on assets that supports electrification and energy efficiency that are installed during FY24 with a maximum claimable expenditure of $100,000. This sets a ceiling of $20,000 as the maximum bonus tax deduction.

Sources: Instant asset write off | Small Business Energy Incentive

We’ve created a simple email template to help you reach out to your clients, inform them of this upcoming change, and help them prepare. Download it here, adapt it in minutes and send it to your contacts.