This policy could make women's super more vulnerable to financial...

Australia’s opposition says early access to superannuation is an election policy for the party’s campaign. But...

READ MORE

Our recent quiz asked eight questions to benchmark respondents' readiness to start their own accounting firms. Just 60% had done enough preparation to take the leap. Here’s four steps the remaining 40% need to take to catch up.

Starting a practice requires time, energy and resources. It’s not a decision to be taken lightly, but one that needs to be made on the basis of myriad factors – such as the demand for your accounting service in the market, startup costs required to get your business off the ground and your level of savings to fall back on in the short-term.

To help you gauge your readiness to start your own practice, Public Accountant developed a short 8-question quiz.

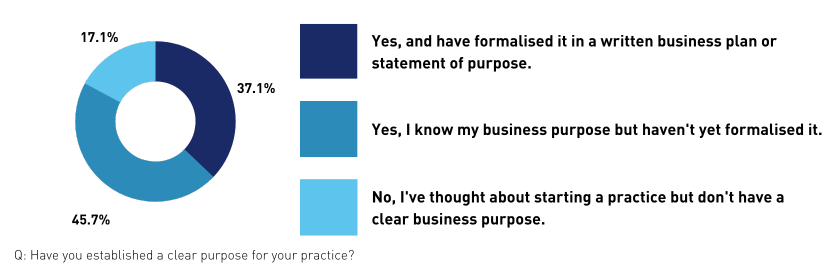

Results suggest that 60% of respondents to the quiz are likely ready to start their own practice. For the remaining 40%, weak spots include clarity on the purpose of the practice, pricing strategy, compliance readiness and the savings to last through the early days.

Missed the quiz? You can take it here.

The majority of respondents have a clear idea of why they would start a practice, whether they have written their purpose into a business plan or not.

Former Best Buy Chair and CEO Hubert Joly, now a true believer in the power of purpose, talks of a ‘Aha!’ moment he had in 2015 when he heard Simon Sinek say “People don’t buy what you do; people buy why you do it”.

This is not only about consumers buying products and services – your team members will more readily buy into and contribute to a collective effort when they understand the part they play in it.

Joly suggests considering:

From there, he encourages leaders to think beyond what the business offers to uncover the deeper human needs it addresses. For example, your accounting clients may not simply need payroll calculations, but to build a business that could provide security and freedom for them and their family.

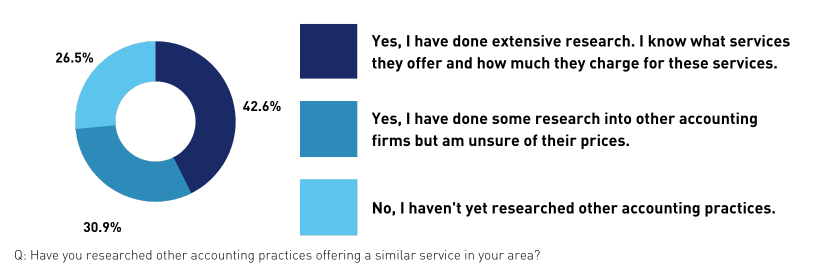

Almost three-quarters of respondents have looked into the other firms they would compete with. However, only around four in 10 have looked at their would-be competitors' pricing.

Particularly as we see a shift from hourly charges and itemised rate cards into value-based pricing, being able to understand other firms’ value and articulate your own becomes essential.

Sandra Andrews shared her value-based pricing model with us recently: “We charge most of our clients a monthly or yearly fee to manage their business. We are a virtual CFO for our clients. We manage their staff, payroll, bookkeeping, end of year accounts.”

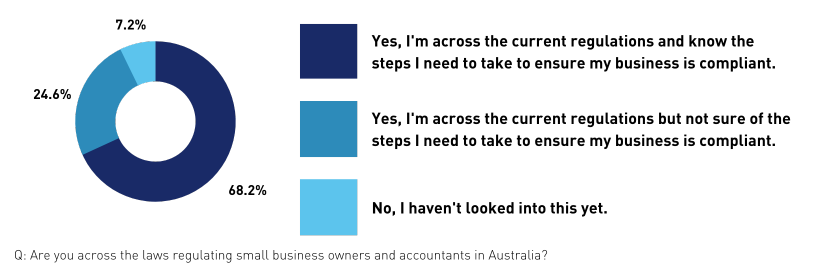

While IPA members who have been in practice advising other small businesses have a headstart on the regulatory landscape for both SMEs and accountants, compliance is still an issue.

Just over 30% of respondents do not have the knowledge necessary to shoulder the regulatory burden effectively and ensure their new practice is compliant.

The IPA’s on-demand CPD series offers short introductions to industrial relations, employment law, risk management, regulatory requirements for new directors and more – and most on-demand CPD is free for members.

The Accounting Professional and Ethical Standards Board (APESB), of which the IPA is a member, also offers guidance to assist accountants in conforming with the Code of Ethics and regulatory standards.

APES 110 Code of Ethics for Professional Accountants outlines the professional obligations and ethical requirements of accountants, based on the five fundamental principles:

APES 205 Conformity with Accounting Standards outlines the responsibilities of accountants to act in the public interest and with due care in preparing, presenting, auditing, reviewing or compiling financial statements.

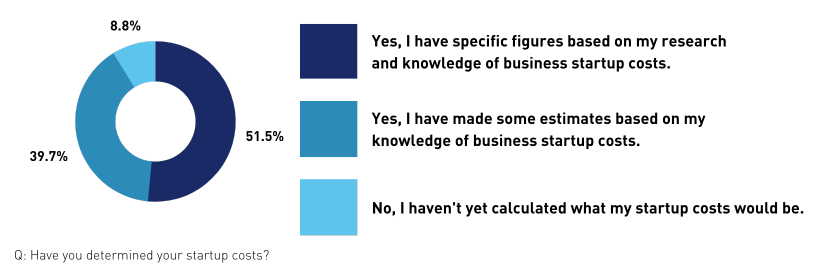

Just over half of respondents have a clear idea of their startup costs, and another four in 10 have some estimates.

Start up costs include:

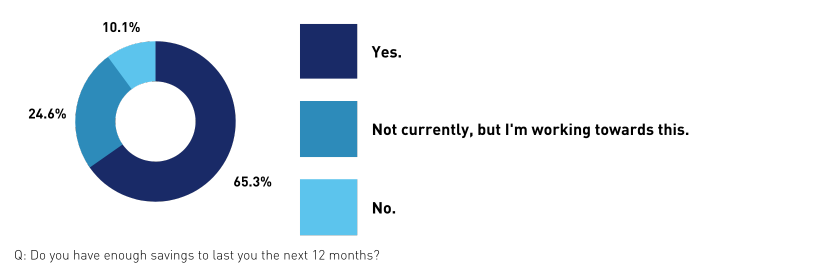

Reassuringly, the majority of respondents had tucked away savings to cover, in their calculations, startup costs and the first 12 months of operating costs.

Need to brush up on your skills? IPA’s Management and Professional Skills CPD bundle offers 11 short courses with a focus on current, practical and tangible skills.