ATO governance needs reform: IPA-Deakin SME Research Centre

The IPA-Deakin SME Research Centre has examined the shortcomings of the ATO’s governance model and proposed a Tax...

READ MORE

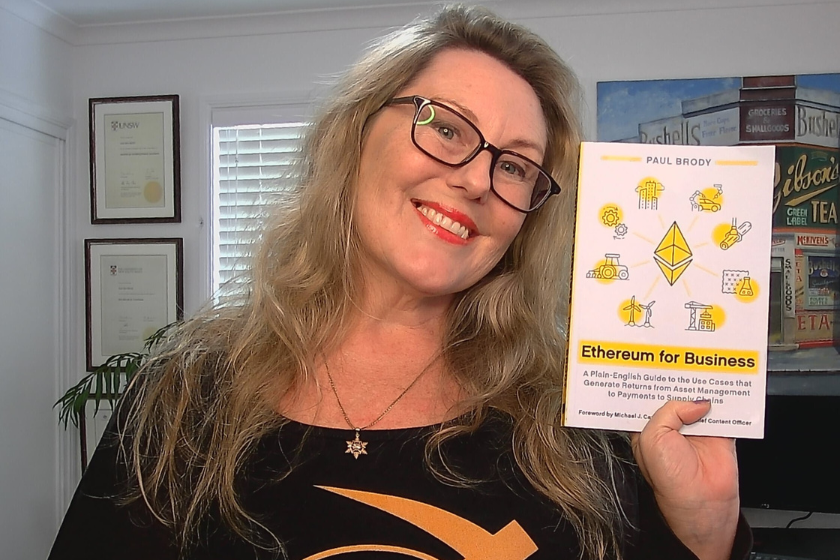

Electra Frost is committed to helping creative and innovative SMEs thrive in a decentralised digital economy.

Since the launch of Bitcoin in 2009, cryptocurrency has transformed from relative obscurity into a US$1.3 trillion market. More than one million Australians currently hold at least one cryptocurrency, and more retailers are starting to deal in crypto payments.

With both individuals and businesses becoming more entrenched in the digital economy, it’s paramount that accountants have the confidence, know-how and resources to help their clients innovate and thrive in this new environment.

Accountant Electra Frost has devoted her career to helping SMEs and their accounting teams gain crucial skills for managing digital assets in business.

“I started accounting when Australians were getting online. And I had a boss who said, ‘we don't want to deal with any of those web-based businesses’,” she says.

“Here I am now, and I hear accountants saying, ‘we're not dealing with any businesses that use crypto’.”

Frost says those accountants are not yet understanding that dealing with cryptocurrencies is inevitable.

Driven by her passion for helping small businesses thrive amid the proliferation of cryptocurrency, Frost has spearheaded initiatives and causes to prepare SME accountants for the future of money.

When Frost founded her own accounting practice in 2008, she was driven in part by frustration with the lack of technological innovation in the broader industry. Her practice navigated the early years of the internet by always experimenting with the cutting edge of technology.

The practice went fully remote in 2016 and continued to expand. However, the pandemic made Frost reevaluate where it could be having the most impact.

“During COVID, it became very overwhelming, and we decided we needed to pivot and remodel our services to be more advisory and management-accounting focused to help [businesses] get through challenging times,” Frost says.

That's when Electra Frost Accounting became Electra Frost Advisory.

“I sold the practice and just went forward with about 20 or 30 clients that needed really attentive monthly advisory advisory services – and we chose the clients that we felt were most viable for our practice to be associated with.”

This meant working with businesses that, like Frost, wished to scale at the forefront of technology, with some open to the possibilities presented by cryptocurrency and blockchain.

“For SMEs, that [mindset] is really important, because the opportunities are there with new technology to scale quite significantly as a small and nimble player.”

Frost’s mission to drive the adoption of new technologies such as cryptocurrency and Web3 extends beyond her advisory practice.

In 2021, she co-founded the Digital Playhouse Foundation, a charity helping to improve the accessibility of digital financial skills for people at risk of falling behind, and leads the Accountants On-Chain project to support entrepreneurship.

Her most recent venture, ElectraFi, is devoted to helping both SMEs and accountants learn, upskill and experiment. She hopes initiatives like this will help to speed up the growth of the decentralised digital economy in Australia.

“Australia is not a global leader [in this space] by any means. There are businesses that are using crypto technologies and looking at tokenisation of real-world assets, but it’s still early days,” she says.

“There are more accountants now who are prepared to deal with people who have crypto, but they're only really thinking about the tax returns. They're not understanding the full application of the technology for commercial reasons.”

Frost has noted many accountants who see crypto as speculative or as a form of gambling, and who are therefore hesitant to accept its adoption in a business context.

“Buying crypto for many is just like investing in startups,” she says. “Bitcoin stands apart. Some crypto is used in significant global blockchain projects. Maybe 90% of them are vapourware, who knows?”

By ‘vapourware’, Frost is referring to IT products that are announced but never delivered – they might cause a stir and even impact a stock price, but they are never a reality. Frost argues that some crypto may be worth that risk, just as some tech investments have been.

“Twenty years ago, a lot of the companies that started when the world wide web began didn't last – but there are some very big ones that did.”

While we are still in the early days of crypto and blockchain adoption in business, it won’t be long before the power of this technology makes it non-negotiable for companies to remain competitive.

“You can’t use current money with Web3, crypto goes with AI, and these are super-fast, super-cheap, decentralised ways of doing business that are just absolutely mind-blowing,” Frost says.

“The opportunities are there, but there are also major challenges because our regulators, tax legislators and accounting standard setters are still catching up. It's really very important for accountants to be at the forefront of this technology, because they need to understand it to be able to guide their clients when new rules come.”

This means accountants need to make the time to reskill in this area and keep up with its rapid technological developments. This is no mean feat; Frost estimates that accountants should be prepared to put in around 10 hours a week to keep up with what's going on in blockchain, crypto and AI convergence.

The challenge of carving out this crucial learning time is what led Frost to switch her own practice to a four-day work-week model.

“We have such a steep learning curve. If we're going to future-proof ourselves this decade, we need to cut down to four days a week. That may sound impossible, but we've got to have time for our professional development and our wellbeing.”